How GME Shows A-Shares and US Stocks Converging, Tweets of the Week

Recently on the ChinaTalk podcast, I’ve done shows on Taiwanese politics, US industrial policy, WWII’s legacy in China, and China’s spies. Do check them out.

The following piece translated in excerpts explores how more retail investors in China have come to put their money in institutional fund managers who market through livestreams and online classes. In the US, retail investors are taking a page out of China’s famously retail-driven A-shares market, with Chamath and WSB echoing the saga of stock influencer ‘Big Brother 777.’

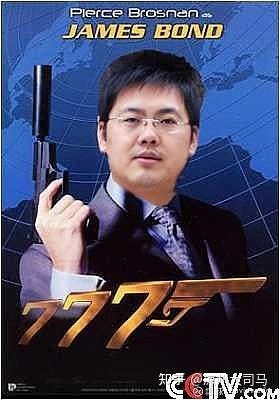

Big Brother 777, China’s u/deepfuckingvalue circa 2007

A-shares and American stocks are converging

Published three days ago on 起朱楼宴宾客’s (Raising a Feast for Guests), author 大伟翁. Thanks to Antony Louthan for help with the translation.

In the US, retail and institutional investors are waging war around GME.

Meanwhile, in China, retail investors decided to set up an online fan club for E Fund Management’s director Zhang Kun. [Zhang Kun, director of China’s largest public fund management company who topped 100bn RMB or 15bn USD in AUM, was showered with the same sort of online praise a pop idol would receive]. The hashtag #E-FundManagementZhangKun had more than 15 million views on Weibo. [Interview with one of the founders of the fund manager’s ‘fan club’ here.]

Working in the financial industry, I have been taught by vets in the game, "Don’t get it twisted: A-shares are driven by the retail market, while institutional investors drive pricing of U.S. stocks."

I never imagined we would witness history as we have in this magical year of 2021 -- How seemingly overnight A-shares and U.S. stocks have started to converge.

Big Brother 777

If you have experienced the A-share bull market from 2007 to 2008, you probably remember "Big Brother 777”.

So how popular was Big Brother 777 back then? Big Brother 777’s traffic was large enough to crash NetEase’s blogging platform.

In May of 2007, Big Brother 777’s posts already had more than 10 million views, making him China’s no.1 blogger.

Although public funds in those two years had the first taste of explosive growth, but more people still prefer to buy stocks themselves, personally following the news and stock recommendations.

At the time there was a viral song "even the dead shouldn’t sell,” and in it a lyric I still remember:

I don't listen to others, I buy by feel, and it's a pleasure to make money.

If you look at the posts in the US WSB subreddit now, it simply gives the illusion of 2007 again. [The article did not reference the GME sea shanty, but sure could’ve…].

Yesterday at noon when watching CNBC's interview with Chamath, the Big Brother 777 of the U.S. stock market's recent events, I could also vaguely see the "style" of the Big Brother 777.

In addition to Big Brother 777’s extraordinary profile picture, the most profound quote on his personal page is:

Stocks are my kingdom, and the retail investor is my brother. If I am here with you, we can overcome all institutions. They will not do nothing but tremble beneath my sword.

To be honest, I think the words of Big Brother 777 are even more powerful than WSB’s. Can he with a short few sentences cause the people’s blood to boil, and make them want to follow him to fight tyrants and share in the spoils?

So, why do U.S. stocks seem to have suddenly become the talk of retail investors, while A-shares have become a haven for institutional investors? Is it really that overnight, the concept of Chinese and American investors has changed dramatically?

This is obviously not possible. But the deep-seated reasons for this are the same, and are both inextricably related to the times.

Let's start with A-shares.

In my opinion, until China's version of 401K pension accounts are in place, and until international investors treat China as a developed capital market, China's stock market will not really become an institution-driven market will not become a mature, rational market dominated by institutional investors.

Therefore, it is not the maturation of Chinese individual investors that has caused the so-called "individual investment institutionalization (基金化)" of the past two years, but rather the simple allure of making money.

For individual investors, if there is no mandatory pension savings or other restrictions, so investment is, in fact, quite simple. The principle is simply to buy whichever kind of assets can make the most money.

Public funds in this bull market have, over the past five years, proven their ability to make money.

The leaders from the first wave of the independent market actually came in 2017. That year LONGi rose 170%, Hikvision rose 150%, while a number of large-cap stocks such as Guizhou Maotai, Wanhua Chemical, Ping An of China, and Midea Group also doubled.

2018 looked like a bear market, but if you investigate deeper, you will find that the decline of the leading firms in that year is actually very limited, so the public funds holding the top companies didn’t lose that much money.

And in 2019 and 2020, these leading companies and the public funds behind them together ushered in an explosive period, which led to strong fund performance. That led to more retail investors putting their money into funds, creating a virtuous cycle for the leading stocks.

In the past few years, top social media influencers have used various methods to "promote" funds, whether through livestreams or interviews, or online financial classes. Of course, this strategy also avoids the legal risks of Big Brother 777 illegal stock recommendations [he spent three years in jail].

Whenever you open Alipay, you’ll see live streams of financial advisors.

So the matter of buying into a fund, especially for those born after 1985 or 1990, is not about doing investment research, but rather listening to the fund manager's investment philosophy, watching his livestream, and maybe even developing an emotional connection.

In addition, investing into funds is now super convenient, and redeeming funds only takes seconds as well.

Let’s take a look again at U.S. stocks: the Gamestop story is certainly inspirational, but at its core it remains an old-fashioned tale about the collective unconscious of the masses.

It is a story of a seemingly plausible triggering factor (a large institutional short position, and the entry of an influential person who could trigger a change in the company's fundamentals), a group of opinion leaders with a clear agenda, and a group of gamblers who live by a YOLO mentality, who, step by step, cause the stock itself to fluctuate dramatically.

But the difference between this story and the past is that the epidemic has left the U.S. with a large number of people who have nothing to do and stay at home, who dare to spend their stimulus check, and whose previous experience of making money on hot stocks like Tesla and Carnival Cruises has bolstered their confidence. They have flocked to GME rallied by the calls to action in internet forums and have found more like-minded "partners" to complete an online version of "Occupy Wall Street".

Tweets of the Week

Thread

I should’ve gone to Tsinghua…

Stay tuned for Scott and Natalie’s ChinaTalk podcast episode…

I’d shuffle around some of these but one of the rare useful 2x2s!

People from India would be PSYCHED about a Russian vaccine. So would people from Mexico. So interesting.