Labs Over Fabs: The Geopolitics of RISC-V

How the open-source ISA could spark a new wave of hardware innovation and what governments should do about it

For the past six months, I’ve been working with Chris Miller (Tufts) and Danny Crichton (TechCrunch) on a Korea Foundation-funded exploration of issues facing the US semiconductor industry. Today I’m publishing the final section, which examines how the US could take advantage of the rise of the RISC-V ISA as well as goes over our takeaways for policymakers. If those words don’t make sense to you, just keep reading, I promise it’s interesting and important!

See here for the full report complete with footnotes and a fancy pdf layout.

We’ll also be doing a zoom event with my co-authors this morning at 9 AM EST. Feel free to register here.

Twenty years ago, a custom chip cost close to $1 billion in engineering, licensing, and production costs. Today, the cost to design a 7nm chip is somewhere around $100m and 1,000 man-years, significantly cheaper but far outside the budgets of most firms and venture capital. Proponents of the RISC-V instruction set architecture (ISA) believe it could bring the cost down to $10 million while creating an open-source standardized ecosystem for all computing devices, leveling the global playing field for chip design, and making extensible, modular hardware design available to all universities and companies. RISC-V’s rise will spark faster innovation from more designers as the development of shared core designs reduces time to market and increases transparency and security.

Some in government and industry worry that an open-source hardware revolution would undercut America’s preeminent position in the chip industry and cede ground to China. However, former Intel CEO Andy Grove once famously quipped that in semiconductors “only the paranoid survive.” This paranoia needs to be channeled to ride—not resist—the flow of technological change. To set America up for the post-Moore’s Law world, where the surface area of the technological frontier gets spread wide, the U.S. government must realize that open-source hardware is coming, and it must invest in the future at home to ensure that it is positioned to lead the field.

What is RISC-V?

An ISA is an abstract model of a computer serving as the boundary between software and hardware, and it is the part of the processor visible to a software engineer. Currently, Intel’s x86 ISA dominates the desktop, laptop, and server market, while ARM drives chips inside most smartphones. RISC-V, first conceptualized in University of California, Berkeley labs in the 1980s, was realized as an architecture, again at Berkeley, in 2010.

The RISC-V Foundation, established in 2015, aims “to build an open, collaborative community of software and hardware innovators based on the RISC-V ISA.” Its members include over a hundred of the world’s leading firms in the semiconductor space, including Qualcomm, Huawei, Nvidia, Alibaba, Google, Western Digital, Cadence, and Samsung. Notable exceptions include Arm and Intel, which see RISC-V as a competitor. Of the eleven premier members whose $100,000-250,000 annual membership fee buys a seat on the Technical Steering Committee, eight are headquartered in China.

Alongside its open-source nature, RISC-V features several revisions to the base ISA model, which give it an edge relative to ARM and x86 for certain types of compute. By building around modern innovations in processor design like instruction compression and macro-ops fusion, RISC-V programs can be more efficient compared to other architectures by conducting fewer operations while using the same amount of memory. In RISC-V, instructions that outlive their usefulness can be easily discarded, allowing designers to save precious silicon and letting the ISA easily adapt to future innovations in micro-architecture. Its simplicity and lack of licensing requirements have also made it attractive as a teaching and university research tool, particularly in Europe, opening up the pipeline for chip talent.

While RISC-V is the first open-source ISA to gain momentum, open-source software has already made an enormous impact on the world. Open-source software is code “designed to be publicly accessible—anyone can see, modify, and distribute the code as they see fit. Open-source software is developed in a decentralized and collaborative way, relying on peer review and community production.”

RISC-V hopes to emulate a growth trajectory akin to network protocol TCP/IP or Linux. Linux, an open-source operating system, was created in 1991 by then 21-year-old Finnish student Linus Torvalds. It started out as a playground for hobbyists and idealists, but eventually became mainstream as thousands of developers’ free contributions made it competitive with Microsoft Windows. IBM’s announcement in 2000 that it would be investing $1 billion into Linux helped legitimize it in the corporate world, helping to put it on a trajectory where today it remains a major alternative to Microsoft Windows. In servers, it holds a respectable 14% market share.

Growth Challenges

RISC-V still has a long way to go to be considered a real competitor to ARM or x86. Open-source hardware faces a far more challenging path to developing its ecosystem than software. First, the technical bar to contribute to an open-source hardware project is much higher and more specialized than most software projects. There are far more people who have picked up a software programming language like C than know enough electrical engineering to make sense of an ISA. Although RISC-V is more straightforward than x86, it still must reconcile the technical input of hundreds if not thousands of contributors, though the centralized RISC-V Technical Steering Committee could accelerate the process more than the decentralized way Linux dealt with problems.

Most importantly, an open-source ISA will struggle to progress without having the actual hardware on hand and creating robust verification systems. Even if RISC-V gets a critical mass of people in academia and industry developing the theoretical ISA itself, the movement will still need to manufacture on silicon to test alterations to the architecture. Arm and Intel have invested enormous sums into verification for their client companies, and firms that branch out into an immature extensible architecture like RISC-V have their work cut out for them. As verification commonly takes two-thirds of the total effort involved in making a modern System-on-a-Chip (SoC), forcing firms who adopt RISC-V to do this themselves is a major burden. One American startup founded by a group of RISC-V leaders, SiFive, is creating one of the first production-ready chips in this ecosystem, attempting to force a complete production pipeline into existence. However, this process will take years to mature.

Other efforts that will fill out the broader RISC-V ecosystem will take as long or longer. Arm was introduced in 1985 as a challenger to the then-dominant x86. It would take 25 years to develop a strong enough ecosystem to enable it to win substantial market share, and only then because Arm became the standard for smartphones and other mobile devices, which grew rapidly in popularity in the late 2000s. The transition to RISC-V should be somewhat more straightforward, however, as Arm and RISC-V are both from the same family of architectures known as reduced instruction set computing.

Entire generations of engineers have cut their teeth on Arm and x86. Even though RISC-V is simpler to work with, most chip designers are specialized to work with x86 and ARM. It will take years to build a new pipeline of professionals, mostly likely those who worked with RISC-V at university, to acquire expertise needed to realize RISC-V’s promise. Furthermore, open-source chip design (EDA) tools to compete with incumbents like Synopsis and Cadence are potentially decades away. Without open-source EDA, RISC-V wouldn’t be all that different from its competitors—just an open-source instruction set relying on the same expensive, closed-source design tools used by x86 and ARM designers.

Vertical-Specific Progress

Despite that myriad of barriers, RISC-V hopes to ride shifting industry trends to greater market share. In earlier generations, steady improvements in general purpose computing drove chip sales. Now, with Moore’s Law slowing down and as more computing is happening in the edge (i.e., in your smartphone, car, or doorbell), instead of in a data center, new requirements that demand optimized domain-specific workloads for a large variety of platforms suit a more flexible architecture like RISC-V.

Internet of Things (IoT) chips comprise the most promising market for RISC-V. Each IoT device, whether a wearable, an internet-enabled thermostat, or a smart speaker, needs a chip customized for its specific requirements. IoT applications don’t necessarily need to be programmable and interface with other applications, making the immaturity of RISC-V compatible software less of a drawback.

Startups in this fragmented space are cost-conscious and have younger, more affordable engineers. As Codasip’s Chris Jones argues,

With so many new IoT applications emerging, the demand for custom silicon keeps rising. It cannot be reasonably expected for the same semiconductor device to run a wireless protocol in one product, to encode video data in a second consumer device, and to perform facial recognition in a third. A chip could be designed in a general-purpose fashion to handle each of these tasks, however it would then be large and power inefficient. That is why the scalability of RISC-V is so attractive, allowing for different performance/power profiles while preserving the software investment across multiple devices.

The largest commitment to RISC-V thus far has come from solid-state drive manufacturers, a relatively straightforward application of the ISA. Western Digital has committed to transitioning a billion cores (today’s processors are often built with multiple processing cores) to RISC-V, and competitor Seagate in late 2020 rolled out two RISC-V processors. Both firms stand to save considerable sums transitioning away from ARM and thereby avoiding that company’s licensing fees. Moreover, they believe their commitments to RISC-V will lead to “lower latency, power savings, higher drive capacities at a faster pace, computational capabilities in storage drives, and improved security for data created at the edge of the network.” Other promising markets include vision systems for cars and security cameras, factory-floor applications, and smart agriculture such as tracking livestock.

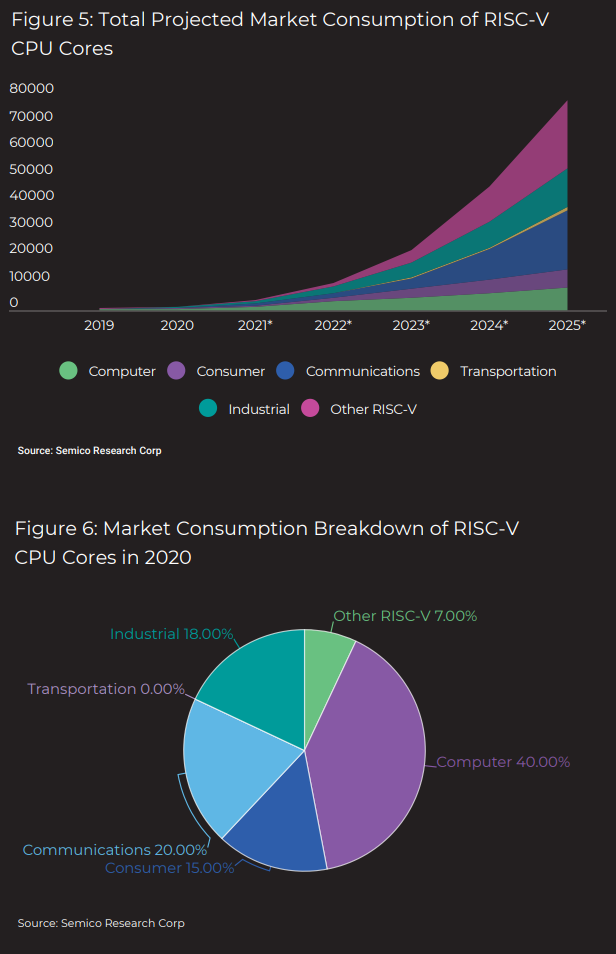

Semico, in a market research project produced in collaboration with the RISC-V Foundation, estimated in late 2019 that RISC-V would capture 4.5% of overall cores consumed by industry by 2025. Given their rather conservative methodology, which linearly extrapolates from present day survey data, it may even possibly underestimate RISC-V’s growth.

China Rising

Today, China has the liveliest RISC-V ecosystem. Every major Chinese tech firm seems to boast a RISC-V strategy, with Alibaba producing what may be the world’s fastest RISC-V chip targeting artificial intelligence applications. Alibaba also announced its desire to put RISC-V at the center of its future cloud and edge computing strategy, while Xiaomi is selling a wearable with a RISC-V based processor. Huawei has announced it was considering adopting RISC-V as a replacement to ARM for its mobile chips. In all, over 300 established firms and startups are working on RISC-V in China. Chinese firms have popped up at all points in the RISC-V supply chain, from core IP design firms like Alibaba’s Dharma Institute and Saifang Technology, to design companies like Zhaoyi Innovation and Beijing Junzheng, and lastly to brand manufacturers like Xiaomi and Huawei.

Xiaomi’s newest Mi Smart Band 5 is powered by a Huami RISC-V core. I own one and it’s very good!

Why the intense interest? As one Chinese media article explaining the importance of RISC-V begins, “You cannot build a house on someone else’s foundation.” While PRC leaders dating back to Mao Zedong have prioritized technological independence to varying degrees, the recent U.S. export control restrictions targeting firms like Huawei have led China to redouble efforts to create a self-reliant technological ecosystem. In particular, U.S. sanctions on ZTE, which nearly killed a $10 billion household name firm, led to a “Sputnik Moment” for both industry and government. ISAs, like EDA tools, are a potential chokepoint for the United States to restrict China’s chip ecosystem. However, despite excitement about RISC-V, the Chinese government has done little to support it, devoting a miniscule slice of the tens of billions publicly committed to boosting the domestic chip industry.

In addition to avoiding U.S. export controls, RISC-V represents Chinese firms’ first opportunity to be present at the creation of a new ISA, benefitting from the opportunity to develop know-how and products alongside a new technological framework. Chinese firms have struggled for decades to build globally competitive chips. The reset that technological shifts and RISC-V portends gives these firms another chance to take market share from Western leaders.

China is by no means destined to dominate the RISC-V space. As Saifang Technology CEO Xu Tao said in a recent interview, “the Chinese ecosystem’s main shortcomings with regards to RISC-V are on the talent, software, and application sides.” Its firms, like the rest of the world’s, lack talent with deep experience in the ISA, though universities are rolling out new teaching materials and conducting RISC-V competitions, and the fifteen thousand who tuned into a recent RISC-V livestream of a conference on the mainland testifies to broad interest. As Xu Tao explained,

“China has never had a real success story when it comes to building a software and application ecosystem…particularly when it comes to basic software like compilers, debuggers, an OS, basic libraries, upper application frameworks, and so on. There are gaps in the overall contribution of similar software, but the current growth is relatively fast. Many domestic companies have continued to improve such software, and the gap is narrowing step by step.”

Other emerging economies could gain from RISC-V’s potential to reshape the industry, too. The Indian government has invested in developing a series of indigenous processors, with IIT-Madras’ Shakti program leading the way. The hope is that a more commoditized industry will undercut premium pricing for processors, upending the semiconductor market and turning the industry into more of a services business. Indian firms, already world-class service providers, could then leverage the country’s electrical engineering talent to compete with the global players on everything outside the highest-end chips.

Should the U.S. fear RISC-V?

Some within the U.S. government fear Chinese firms’ eagerness to adopt RISC-V. Given that open-source software enabled the rise of Chinese internet tech giants like ByteDance and Tencent, some think RISC-V could presage similar dynamics in the hardware space, whereby Chinese firms backed by government subsidies could capture the domestic market. RISC-V could replace Western intellectual property. In such a case, chip design could become more of a commodity whereby China’s scale and capacity for subsidies could flood the global market. Serge Leef, a DARPA microcontroller product manager, argued in January 2021 to the Wall Street Journal that RISC-V could be “giving China a leg up on all these technologies because they can now save 20 years of engineering and catch up to Western technology overnight? It’s not unlikely.”

In early 2020, the RISC-V Foundation reincorporated from the United States to Switzerland in a bid to “calm concerns of political disruption to the open collaboration model.” Some Chinese lead

Although the announcement was praised by firms like Huawei, the move doesn’t guarantee that RISC-V will stay outside the reach of U.S. export controls. If the U.S. government was determined, regardless of the Foundation’s domicile, it could very well put much of the intellectual property out of the reach of Chinese members, or at the very least fracture the Foundation such that U.S. firms could no longer contribute to the community and have to start their own independent line of the project. That said, many U.S. firms are likely to lobby to keep RISC-V open, as only Arm and Intel would potentially gain from an aggressive export control policy directed at the ISA.

Though some in Washington fear RISC-V, the United States has much to gain from RISC-V—if it can take advantage of the opportunity that open-source hardware provides. Open-source software powered the rise of today’s American software giants. While the rise of RISC-V would lower the price of chip design and lead to commoditization in some areas in the semiconductor industry, it would shift the key point of competition from capital to design creativity. This would play to America’s strengths as the global leader in producing high-end engineering talent and matching it with business acumen. What’s more, so long as open-source EDA tools are a long way off, the United States will still have a choke point to squeeze Chinese firms for a long time. Moreover, U.S.-based SiFive is today best-positioned to develop a leading role in the global RISC-V ecosystem among new chip companies.

So what should the United States do to invest in the open-source hardware paradigm? First, the country should put in place a policy of “do no harm,” and instead encourage more development and growth of this important sector. It should subsidize additional research at university and industry research labs, encourage and underwrite student training in this new space, and work to build a handful of centers of excellence that not only propel the technology forward, but also connect researchers and academics to industry.

DARPA has a role to play in pushing out the technological frontier. However, as one DARPA project manager said in relation to RISC-V, “DARPA funds projects not infrastructure.” To support the broader ecosystem to revitalize the domestic chip industry, the United States needs investments in companies that are willing to look on a longer investment horizon than Silicon Valley has for a return. For the past 20 years, American VCs have been less interested in semiconductor startups, citing their high startup costs and low growth in the industry. Given that firms (like Redhat) based on open-source technologies have taken a long time to mature, government could do more to invest in building out this ecosystem. Congress should consider earmarking funding for open-source hardware technologies into the Endless Frontier Act aimed at boosting research and development.

Conclusions

With the U.S. semiconductor industry facing intensified competitive pressure—and with computer chips playing a fundamental role in America’s accelerating technology competition with China—policymakers are taking chips more seriously than they have in decades. Today, semiconductor shortages are impact supply chains for goods like autos. Yet, discussion about risks to America’s semiconductor sector are too focused on specific subsets of the industry at the expense of the broader ecosystem. On top of this, U.S. debate too often turns toward how to defend existing advantages rather than how new innovation can shift existing paradigms.

Congress and the Biden administration are considering ways to support the industry. The history of the industry suggests that trying to subsidize specific firms or today’s technologies is likely to fail. The government is not going to have better knowledge than semiconductor industry experts themselves about the future of technology. The industry simply moves too fast for Congress or the White House to pick winners or to understand the technology trajectory with enough granularity.

Rather than trying to protect specific firms or to acquire a defined set of technological capabilities, the government can help by supporting a healthy semiconductor ecosystem, including a well-trained workforce; an amply-funded venture capital environment, especially for early-stage firms; and an educational system that fosters new and disruptive ideas.

The U.S. government has a long track record in playing this role, from the invention of the first silicon chip. Research into next-generation technologies; fostering partnerships between government, universities, and companies; and using existing government bodies like DARPA and In-Q-Tel to support microelectronics are ways that Washington can bolster the chip industry without trying to take major bets on specific companies or technologies.

Some in industry and in Congress have advised spending billions of dollars subsidizing the construction of new manufacturing facilities (“fabs”) in the U.S. Given that the most advanced new fabs can cost up to $20 billion to build, its not clear that subsidizing fabs is the most cost-effective way to support the industry. For example, during the 1980s, the investments in university research centers that seeded U.S. dominance in the sphere of electronic design automation cost tens of millions, not tens of billions. It is these investments that help make U.S. export controls on China effective today. The other “chokepoint” technology that the U.S. current controls is in semiconductor manufacturing equipment, a subset of the semiconductor sector that has attracted far less public attention than chipmakers themselves. But for U.S. foreign policy, manufacturing equipment is no less important.

Subsidizing the construction of fabs will certainly boost the semiconductor industry, providing more semiconductor jobs and strengthening the ecosystem. But policymakers must ask whether it is the most cost effective way to accomplish this goal. The two leading chip manufacturers, Samsung and TSMC, are both foreign companies, so even if they agree to set up new facilities in the U.S., their core technology and R&D will continue to take place mostly abroad. Moreover, the leading U.S. chip manufacturer, Intel, is already highly profitable and already produces a major share of its chips in the U.S. It has reported billions of dollars even profits during the period in which it lost its manufacturing edge to TSMC and Samsung. Lack of funding wasn’t the cause of their technological issues, and it probably won’t be the solution. It would be smarter for the U.S. government to consider how it can support Intel’s efforts to expand potential growth markets, such as chips needed for O-RAN telecoms technology.

A final recommendation for policymakers is to take a sophisticated approach to open-source software. Some media reports have characterized open-source as a tool for China to undermine U.S. intellectual property or market dominance. In fact, the U.S. could be the greatest beneficiary of increasing use of open-source architectures if this unlocks new creativity in chip design, a segment in which the U.S. plays a leading role. Government can be supportive by seeing open-source not as a threat but as an opportunity, and helping to educate a workforce that is familiar with open-source designs.

Loved this, nice work!

Good stuff, thanks guys!