A Biotech Strategy Toolkit

capital, talent, and supply chains

Created by the United States Congress in 2022, the National Security Commission on Emerging Biotechnology (NSCEB) is an independent, bipartisan body tasked with assessing biotech’s national security implications. Modeled after the earlier AI Commission, the NSCEB recently released its report of recommendations to ensure the US's future leadership in biotechnology.

Their report signals something important: biotech is moving from policy background noise to strategic priority. But key parts of the discussion remain murky. The term “biotech” is used broadly, without disaggregating research from regulation and pharmaceuticals from agriculture. “China” is everywhere in the report — proving the need for additional analysis of the real ins and outs of Beijing’s biotech system. This article attempts to provide that supplemental understanding.

Let’s start by unpacking the first problem: what is biotech?

What is biotech?

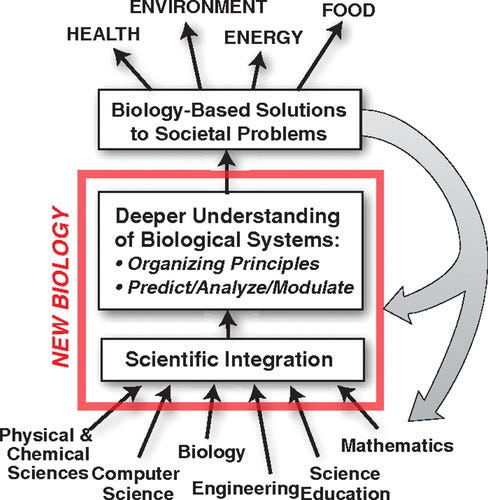

The NSCEB defines biotech as “the design and engineering of biological systems, devices, and parts,” which intersects with a range of sectors: defense, industrials, consumer goods, healthcare, agriculture, and energy.

A whole-of-nation, holistic approach to biotechnology makes sense — to a point. Gene editing tools, bioengineering platforms, and computational models of biology do have broad cross-sector potential. But to craft policy, allocate funding, and set regulatory guardrails, the catch-all term “biotech” is too blunt to be useful. For each biotech sector, the stages of development, degrees of maturity, funding dynamics, regulatory environments, and end-user stakes vary so widely that generalizing becomes a liability.

Consider a few examples:

Health biotech: a mature, well-capitalized sector about one-half of the total biotech market. It operates within a highly structured regulatory system, is driven by both public research and large-scale private investment, and faces challenges with cost, access, and long timelines.

Examples: mRNA vaccines, biologic drugs for cancer treatments

Agricultural biotech: an established sector with capital markets less than one-tenth the size of pharma. It operates in its own silo of regulation and is highly influenced by public perceptions.

Examples: genetically modified crops, biofertilizers

Industrial and biomanufacturing biotech: an emerging field that faces major scale-up challenges. Success depends less on regulatory approval and more on economics: whether these products can compete with traditional alternatives.

Examples: biofuels, bioplastics

Defense biotech: mostly in the R&D and prototyping phase. Funds come almost entirely from government sources, goals are strategic rather than commercial, and products are often dual-use or classified.

Examples: biosurveillance,1 combat medicine

There’s no easy way to capture everything biotech touches in a single report, and the NSCEB’s efforts to visualize the big picture are important. Still, the complexity and rapid evolution of the field is exactly why specificity matters. Effective biotech governance requires a modular, sector-specific approach that aligns policies with actual economics, risk profiles, and social impacts.

Tailoring policy to the needs of each biotech sector will also sharpen how we evaluate progress. One of the benchmarks the US is already using is China — so it’s all the more important to take stock: what’s happening across China’s biotech landscape?

What’s going on in China?

China is the organizing principle of the NSCEB report. Chinese government and private sector activity shaped policy recommendations, defined success metrics, and fuelled a sense of urgency.

But if the Commission wants to meet the challenge it outlines, US policy must be grounded in a more detailed understanding of China’s biotech system: its strengths, its weaknesses, and its trajectory. Misreading the landscape risks building American strategy on flawed assumptions, allowing public resources to flow into the wrong problems or reinforce the wrong incentives.

So, let’s turn headlines into hypotheses. What follows is a toolkit for transforming common claims about China’s biotech sector into sharp, curiosity-driven questions – the kind that demand deeper analysis but can inform good policy.

1. The Money Question

Claim: China is spending billions on biotech.

Question: How much is China investing in biotech, and how well is it being spent?

China has identified biotechnology as a strategic priority. Budget allocations reflect this shift: China spent roughly US$34.5 billion (RMB 249.7 billion) on science and technology in 2024, and earmarked US$55 billion (RMB 398.12 billion) for 2025. However, disaggregating biotech from broader S&T initiatives — and parsing where spending falls across research, development, and commercialization — remains difficult. For instance, China’s 2024 investment of US$4.17 billion in bio-industrials and biomanufacturing is hard to categorize by stage. What’s clear is that the bulk of China’s biotech policy continues to prioritize biopharma, the most dominant part of the sector.

The efficiency of China’s public biotech funding ecosystem also requires investigation. One Chinese professor observed: “Money is no longer a major issue… the problem is with the funding system.” Government ministries, national foundations, and provincial and municipal governments all deploy biotech-linked funds, and a lack of coordination and transparency between actors can lead to redundant or wasteful spending. Fund allocation is also uneven, often favoring large, top-down projects aligned with national priorities — an approach that can be ill-suited to biotech, where breakthrough directions are inherently unpredictable. High competition and the short-term structure of grants further limit incentives for more high-risk innovation.

Private capital is equally important to understand. In key application areas like pharmaceuticals and agriculture, private investment plays an outsized role in shaping what gets developed and what reaches the market. China was the second-largest destination globally for biopharma venture funding in 2018–2019, raising around US$60 billion. Such a metric is less impressive in comparative terms: the US raised US$212 billion in the same period, and China’s innovative capabilities remain limited by its less robust private sector. But since the COVID-19 pandemic, China’s capital markets have cooled, and many biotech firms have scaled back R&D. The survival rate and long-term viability of these Chinese start-ups remain undecided.

What should the rest of the world do?

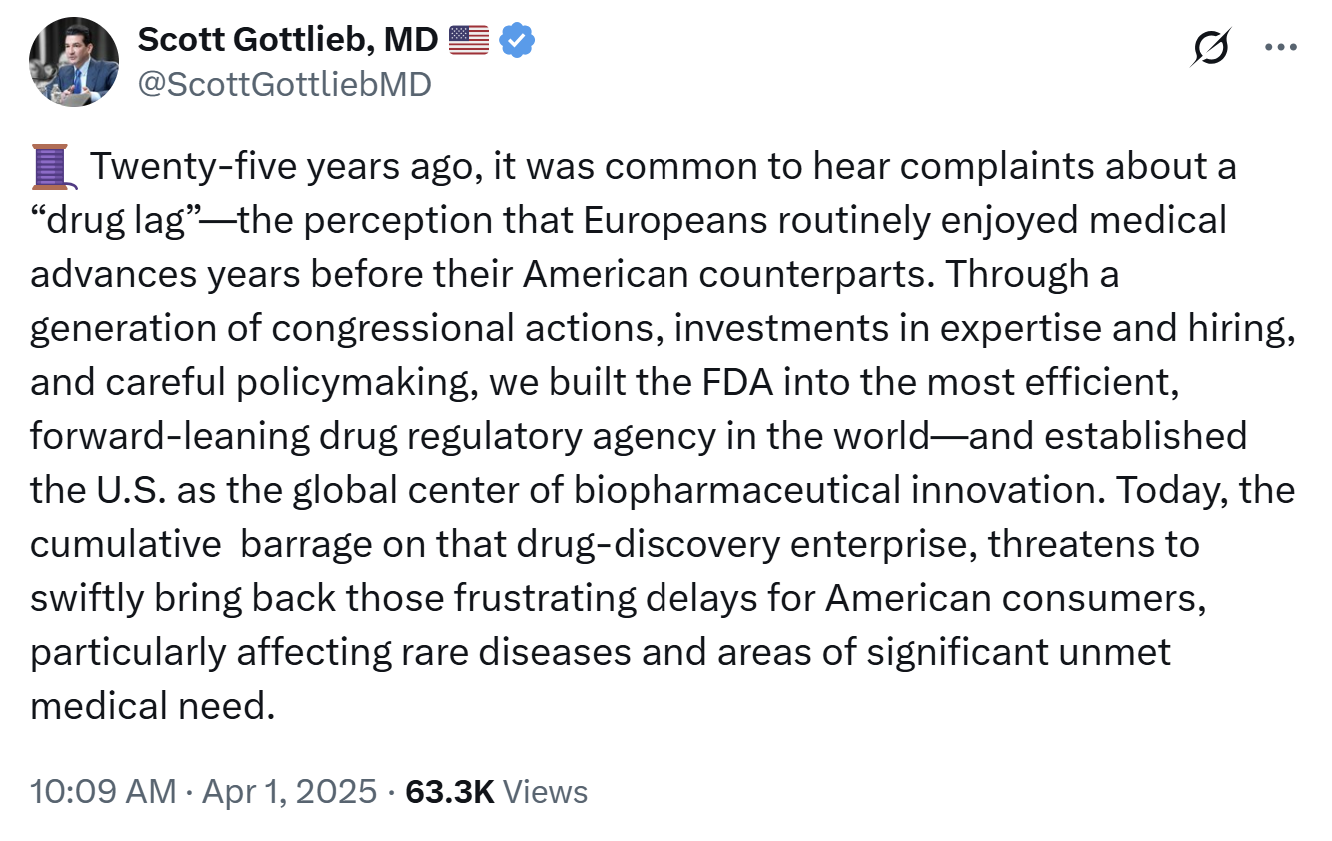

Following China’s actions, other nations could also identify biotech as a national priority deserving serious investment. The NSCEB’s primary recommendation for the US government to spend “minimum of US$15 billion over the next five years” on biotech is a necessary first step – especially at a time when US R&D spending as a share of GDP has declined significantly2 and federal science funding faces mounting pressure from grant freezes and budget cuts.

At the same time, China’s “whole-of-nation” approach to biotech comes with clear challenges: bureaucratic fragmentation, inefficient capital deployment, and misaligned incentives. For the rest of the world, effective biotech policy need not require the same holistic approach. For instance, the US already has a strategic advantage in its robust, innovation-driven private sector – the question is how to unlock that capacity more systematically. The NSCEB’s proposals for an ‘Independence Investment Fund’ to support high-potential startups, advance market commitments (AMCs) and offtake agreements to smooth demand signals, and the restoration of full R&D expensing under the tax code are smart practical levers to promote biotech.

Strong policy deploys public capital to make innovation easier: incentivizing early-stage R&D, derisking scale-up, and building stronger bridges between public goals and private execution.

2. The People Question

Claim: China is building a massive biotech workforce of domestic and global talent.

Core Question: What is the size of China’s talent base, and how sticky is it?

Over the past two decades, China has modernized its education system with the goal of cultivating world-class science and technology talent. Government education expenditure as a share of GDP rose from 2.5% in 1998 to over 4% since 2012 and has stayed above this benchmark through 2024. Such investment spans all levels of education: primary and secondary schools are integrating more STEM into their curriculums, and the number of STEM undergraduate and PhD degrees awarded in China grows each year. 45% of China’s STEM PhDs now come from top “double-first class” universities, indicating their quality.

However, academic programs may still fall short when it comes to preparing talent for biotechnology. In one survey, a third of Chinese biopharma companies reported persistent R&D hiring gaps, citing academic curricula that lag behind industry needs. Industry experience, including the ability to translate research into commercial products and to build and lead globally competitive biotech firms, remains underdeveloped. This gap in managerial and translational expertise has become a core constraint on ecosystem growth. While China’s high-skilled STEM workforce is expanding, it still represents a relatively small share of the overall population. The imbalance between supply and demand has led to intense competition for talent — reflected in an 18.0% active turnover rate in pharmaceutical R&D in 2020.3

Beijing is also seeking to bring back Chinese professionals educated or employed overseas. The National Science Fund for Distinguished Young Scholars supports scientists conducting basic research, provided they spend at least nine months a year in China. The Thousand Talents Plan offers returnees signing bonuses, high salaries and funding, housing assistance, and family support. Such programs, while not unique to China, intend to strengthen the country’s domestic research and innovation capacity.

These programs have mixed effects. Government statistics report a growing proportion of returnees each year. At the same time, both the flow of Chinese students going abroad and the rate at which they stay overseas after graduating have held steady. As of 2019, for instance, over 90% of Chinese AI talent educated in the US have chosen to remain in the US. While China has become more attractive for returnees — thanks to rising living standards, a growing private sector, and increased R&D investment — many of the original push factors remain. Concerns about academic and political freedom, limited job prospects, and digital censorship continue to shape decisions to stay abroad. Some of those who do return are frustrated with lower-than-expected salaries, shortages of postdoc positions and jobs, and reverse culture shock.

Demographic pressures are pushing China to diversify its talent base. China’s college-aged population is declining and has been on a marked downward trend for more than a decade. Ongoing labor market challenges are likely to further drive down Chinese postgraduate enrollment. Beijing has made efforts to attract global talent, including a series of immigration reforms in 2017, but those reforms have yielded limited results. Since 2017, China has risen only modestly in the Global Talent Competitiveness Index4 and still ranks below the top 35 countries. Fewer than 7% of the country’s PhD enrollments are foreign. Political, professional, linguistic, and cultural barriers continue to limit China’s appeal to global researchers.

What should the rest of the world do?

As the NSCEB observes, demand for biotech talent is growing faster than supply. China’s comprehensive workforce strategy — from early education to postgraduate opportunities — should push countries like the US to invest just as broadly in domestic and global talent. And with clear cracks in China’s own approach, now is the moment for others to act.

Fewer than 30% of American public school biology classes include molecular biology content,5 the foundation of most biotech today. Undergraduate biology curricula can be overly rigid and siloed, failing to match biotech’s interdisciplinary nature. Federal and state investments in modern lab infrastructure, teacher training, and interdisciplinary STEM curriculum development could begin to close the preparation gap.

Undergraduate and graduate research opportunities also remain unevenly funded, and too many STEM students face degree-to-career dead ends. In a field as technical as biotech, talent needs to accumulate experience and credentials in a way that stacks. That means investing in well-paid postdocs, lab-intensive training, and academic–industry bridges that allow talented people to do innovative work. One analyst notes this is where the US holds a comparative advantage over China: postdoctoral programs that offer real research experience and career growth.

At the same time, the US’s ability to attract and retain global talent is one of its greatest strategic assets. Over 75% of international students who earn STEM PhDs in the US stay for at least a decade, contributing to vital sectors like AI. Chinese officials regularly cite such US retention of Chinese talent as a key obstacle to their national goals. The NSCEB report cites Jeremy Neufeld, who emphasizes the importance of STEM immigration for the defense-industrial base, writing:

Existing restrictions on STEM immigration — and the resulting backlogs and waiting times for STEM talent — hamper the defense industrial base’s growth. Without reducing the barriers to high-skilled immigration, efforts to onshore and strengthen critical industries in the United States will face significant hurdles, and may fail altogether.

To maintain an edge in biotech, the US needs to double down on reinforcing the pull factors that make it the world’s premier destination for scientific and technical work while addressing the growing push factors that drive talent away. Staying attractive for global talent requires investing in research and building secure career pathways. At the same time, streamlining visa transitions and expanding green card availability for advanced STEM grads can help send a clear cultural and political signal that global talent is welcome.

3. The Supply Chain Question

Claim: The US is dangerously dependent on China for pharmaceutical supply chains.

Core Question: How concentrated is China’s role, and how relevant is this to biotech competition?

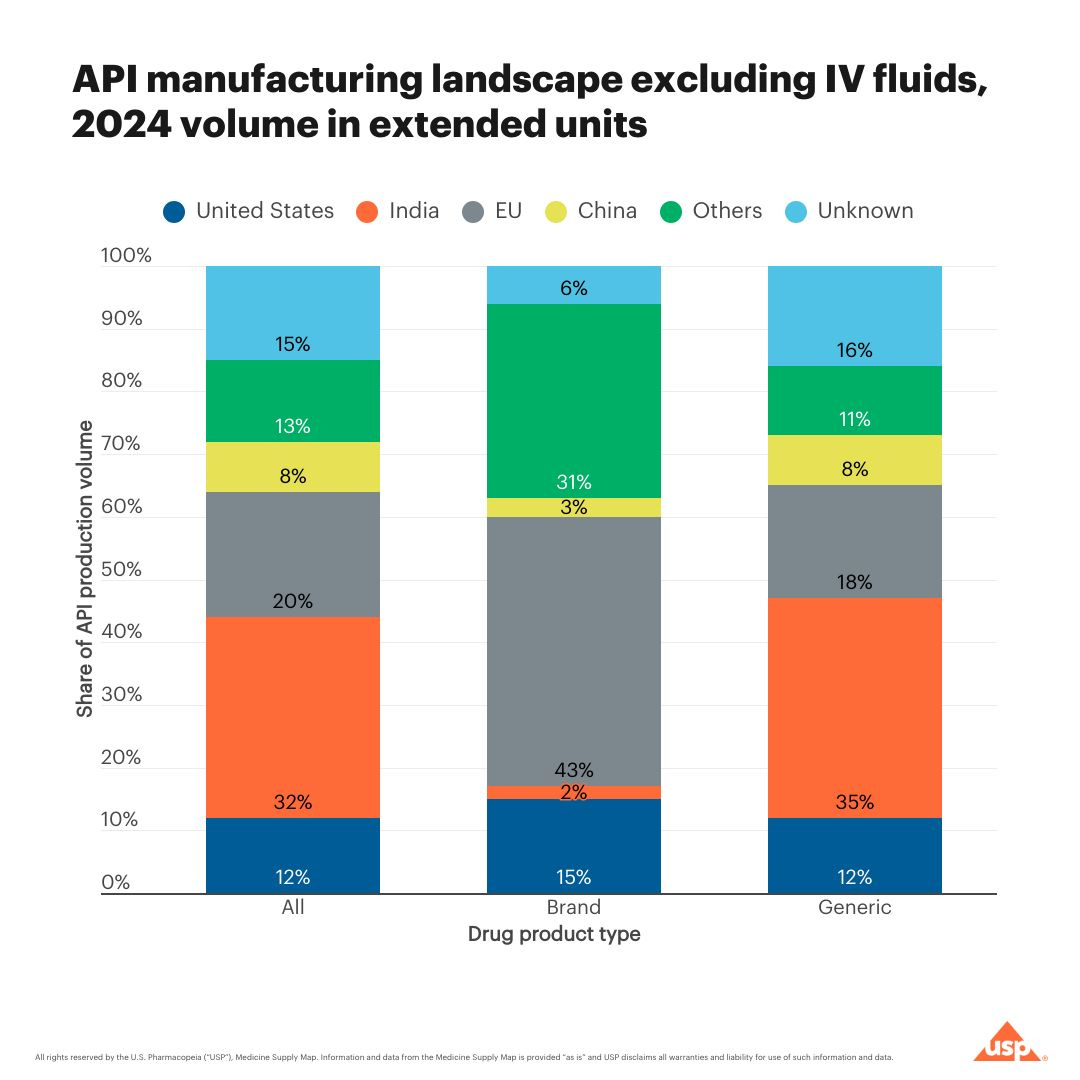

Pharmaceutical supply chains are commonly cited as a source of concern when it comes to China and biotechnology. However, available data does not support the narrative of overwhelming US dependence on China for pharmaceuticals. While China plays a significant role in upstream chemical manufacturing, pharmaceutical supply chains are globally distributed, multi-step, highly fragmented, and frequently outsourced — making US exposure indirect and difficult to isolate.

For example: in 2024, China was responsible for less than 6% of US imports of finished pharmaceutical products.6 As for APIs (the component of a drug responsible for its therapeutic effect), current data suggests that between 2014 and 2022, 17% of APIs used in medicines in the US were imported from China. In 2024, that share fell to 8% for prescription medications. The oft-cited “80% of APIs come from China” is an unsubstantiated misinterpretation of a government statement that has since been clarified. India and Ireland are both larger exporters of APIs and finished medicines to the US than China.

China’s footprint in pharmaceutical supply chains is primarily upstream, producing key chemical inputs and APIs that pass through multiple global intermediaries before reaching consumers. This prominence is largely in small-molecule generic drugs, which are manufactured through chemical synthesis. This matters because chemical manufacturing and biomanufacturing are fundamentally different in terms of core technologies and processes. Much of what’s described as “biotech supply chain risk” is actually about commodity chemical inputs for generics — a sector adjacent to, but distinct from, modern biotechnology.

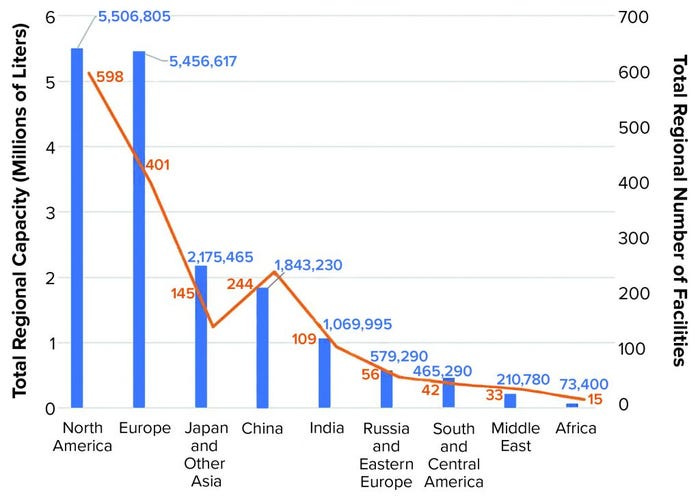

China’s footprint in biomanufacturing requires investigation into biologics (medicines derived from living cells, rather than through chemical synthesis; typically large and complex molecules such as proteins and antibodies). In biopharmaceutical supply chains, China’s presence is limited but its capabilities are growing.

Chinese biopharmaceutical manufacturing capacity represents about 10% of the worldwide total, third globally behind the United States and European Union. Much of this capacity was built after 2016, following a major regulatory change7 that opened China’s market for contract manufacturing organizations (CMOs) that provide small-scale and large-scale drug production services to pharmaceutical companies. Multinational CMOs like Boehringer Ingelheim, Lonza, and Samsung Biologics now operate facilities in China. Among domestic CMOs, WuXi Biologics is widely considered a biomanufacturing leader by the industry, though it has recently faced setbacks due to political scrutiny. Following Beijing's recent pledge to accelerate biomanufacturing, China's capacity in this sector is poised for significant growth.

What should the rest of the world do?

De-risking pharmaceutical supply chains from China starts with recognizing their complexity. Exposure to China is real but often indirect. When it comes to small-molecule generics in particular, the economics of onshoring rarely add up on their own. These drugs operate on razor-thin margins, giving manufacturers little incentives to invest in quality or resilience – even with tariffs in place. Building more resilient supply chains at home will require accepting trade-offs such as higher costs for payers and consumers. Meaningful incentives for domestic production will require government intervention through policy tools such as targeted subsidies, publicly-funded manufacturing infrastructure, and expansion projects such as BARDA’s work to build out domestic biomanufacturing for vaccine production and distribution. And as supply chains are restructured, regulatory oversight will need to scale as well. In the US, a stronger, better-resourced FDA will be essential to maintaining quality, consistency, and compliance.

On the biotech side of pharmaceutical supply chains, the focus should be on reinforcing homefield advantages and lowering the barriers that keep domestic firms from scaling. One key advantage is talent: biomanufacturing depends on engineers, technicians, and regulatory specialists with deep expertise. Strengthening training pipelines — through programs like the National Institute for Innovation in Manufacturing Biopharmaceuticals, a public–private partnership highlighted by the NSCEB — can help expand this critical workforce. Regulatory credibility is another asset the US shouldn’t take for granted: the FDA still carries far more global trust than its Chinese counterparts. Meanwhile, high startup costs for facilities, equipment, and compliance systems remain a major barrier for domestic firms, requiring targeted investment to lower the threshold for entry.

In Sum!

“China” is often invoked as if it were a unified actor with perfect coordination and seamless execution. Reality is more complicated. Behind some impressive numbers and case studies are real growing pains: capital inefficiencies, inexperienced management, limited regulatory expertise, gaps in early-stage funding, underreported failures, uneven enforcement, and dependence on global partners.

In this respect, China is not an exception. Innovation is rarely a simple narrative of linear progress. But as more eyes turn to China, and as real changes unfold within its biotech ecosystem, careful observation and accurate analysis become all the more essential. Meeting this moment requires asking the right questions to understand how capital is deployed, how talent systems function, and which parts of the supply chain actually matter.

The point isn’t to downplay China’s rise in biotech. It’s to understand it on its own terms — and in doing so, craft smarter, more grounded policy.

Biosurveillance is the systematic collection, integration, analysis, and timely communication of information about biological threats to humans, animals, plants, and the environment for early warning and effective response.

Total turnover rate was 20.7%. A high active turnover rate, which only measures voluntary, employee-initiated departures, reflects a competitive labor market in which employees feel free to leave for better compensation, culture, and career opportunities elsewhere.

Compiled annually by the business school INSEAD.

Molecular biology content that prepares high school students for biotech careers covers core concepts like DNA, gene expression, and genetic engineering, while emphasizing hands-on lab skills such as PCR, gel electrophoresis, and bacterial transformation.

Referring to the Marketing Authorization Holder (MAH) system.