Zhipu and MiniMax IPO

prospectus treasure-hunting!

This month both Zhipu (also known as Z.ai) and MiniMax made initial public offerings (IPOs) on the Hong Kong Stock Exchange (HKEX), making them the world’s first two pure-play AI companies to go public. Securities laws generally require companies to submit lengthy prospectuses disclosing information relevant for investors before offering shares to the public. In the cases of Zhipu and MiniMax, these are gold mines of information about not only their corporate fundamentals, but also their views on AI, internal culture, and how they fit into the Chinese AI puzzle.

I spent the past few days with these prospectuses and came out of reading with a plethora of observations and questions. Below are some findings and early thoughts, featuring:

Zhipu’s Model as a Service (MaaS) = SaaS + AI?

China’s competitive, ever-changing cloud computing landscape;

AGI is what you want it to be;

And an early look at how good of a business AI boyfriends are…

What is the product?

Going public requires a company to be very explicit about what they are selling. Here, the two companies diverge the most. Zhipu frames its product strategy around model-as-a-service (MaaS — an acronym which appears 96 times in the prospectus), while MiniMax has an array of diverse products that consumers are already familiar with, from chatbots and video generation platforms to its signature companion app Talkie/Xingye. But MiniMax, self-reportedly, also wants to deliver “technology as products.”

MaaS customers buy access to the AI model, rather than products built on top of, or outputs generated by, the model. In other words, this emphasis on MaaS tries to turn the pure-play AI market into a kind of (mostly B2B) SaaS, with API calls at the center.

The impulse to constantly assert that the technology itself is the product is an interesting one. Both Zhipu and MiniMax are eager to describe themselves as foundation-model companies first, even if they have more specific application products that are clearly profitable (in the case of MiniMax). Is this a move to persuade investors to support costly R&D? Or to gain credibility as frontier labs in a hostile Western-dominated landscape? Or is it both?

Who’s buying from them?

We learn from Zhipu’s prospectus that it considers the public sector to be a significant source of revenue. It has particularly courted the telecommunications sector, which is heavily dominated by state-owned enterprises (SOEs) in China. Of all the revenue it derived from on-premise deployment — the preferred format of public-sector clients due to privacy considerations — in the first nine months of 2025, 13.6% came from telecommunications, while a further 29.4% was derived from other public-sector clients. Its second-biggest customer in 2025 was almost certainly the Ningxia branch of China Telecom (“a telecommunications network operation Company … [which has] a registered capital of RMB213.1 billion and is listed on both Shanghai Stock Exchange and HKEx”, per the prospectus). While the prospectus does not explain exactly how much of Zhipu’s overall revenue comes from government organs and SOEs, we can surmise that the percentage is significant.

With its Tsinghua roots, Zhipu is a state-fund darling. In comparison, MiniMax hasn’t courted as much government money. Both companies disclosed the amounts of government grants each received per year in their prospectuses:

In terms of the private sector, Zhipu names five real-life clients in its prospectus: Kingsoft Office (金山办公, the company behind popular Chinese office suite WPS Office), Nieta (捏Ta, an AI character creation platform), the hiring platform Zhaopin.com, Inner-Mongolian dairy producer Mengniu (蒙牛), and the academic database AMiner. Their case studies reveal interesting insights into exactly how companies are deploying AI.

The cases range from obvious practical use cases to the more experimental. In the case of Zhaopin.com, Zhipu helped the site build a conversational chatbot assistant for jobseekers and recruiters. Dairy firm Mengniu used Zhipu’s model for an “AI nutritionist” mini-app where users can ask questions about healthy eating and track daily habits.

Kingsoft Office and AMiner both used AI models to summarize and generate documents within their ecosystems. Nieta is the only multimodal case: Zhipu helped them launch a short-form video generation agent on their platform. A Chinese analyst described the resulting tool as “Sora for anime fans”:

We also get confirmation that Zhipu is involved with sovereign AI efforts in Southeast Asia, in the form of “building national and municipal foundation model platforms.” Zhipu earned almost 18 million RMB (around US$2.6 million) from deploying large models on-premise in Malaysia and Singapore in the first nine months of 2025, compared to 860,000 RMB (~US$123k) in the US for the same types of services over the same period. These three are the only markets where Zhipu has helped customers deploy on-premise.

MiniMax’s offerings are more consumer-facing, and its prospectus paints a broader picture. In terms of user numbers, they report that more than 212 million customers across 200+ countries and regions used their AI-native products in the first nine months of 2025. That’s roughly the population of Brazil!

Where are the GPUs from?

We learn from MiniMax’s prospectus that it does not have its own training clusters and has no meaningful local compute. The company calls it a “light-asset” strategy. (It also outsources content moderation, digital marketing, and data labelling.)

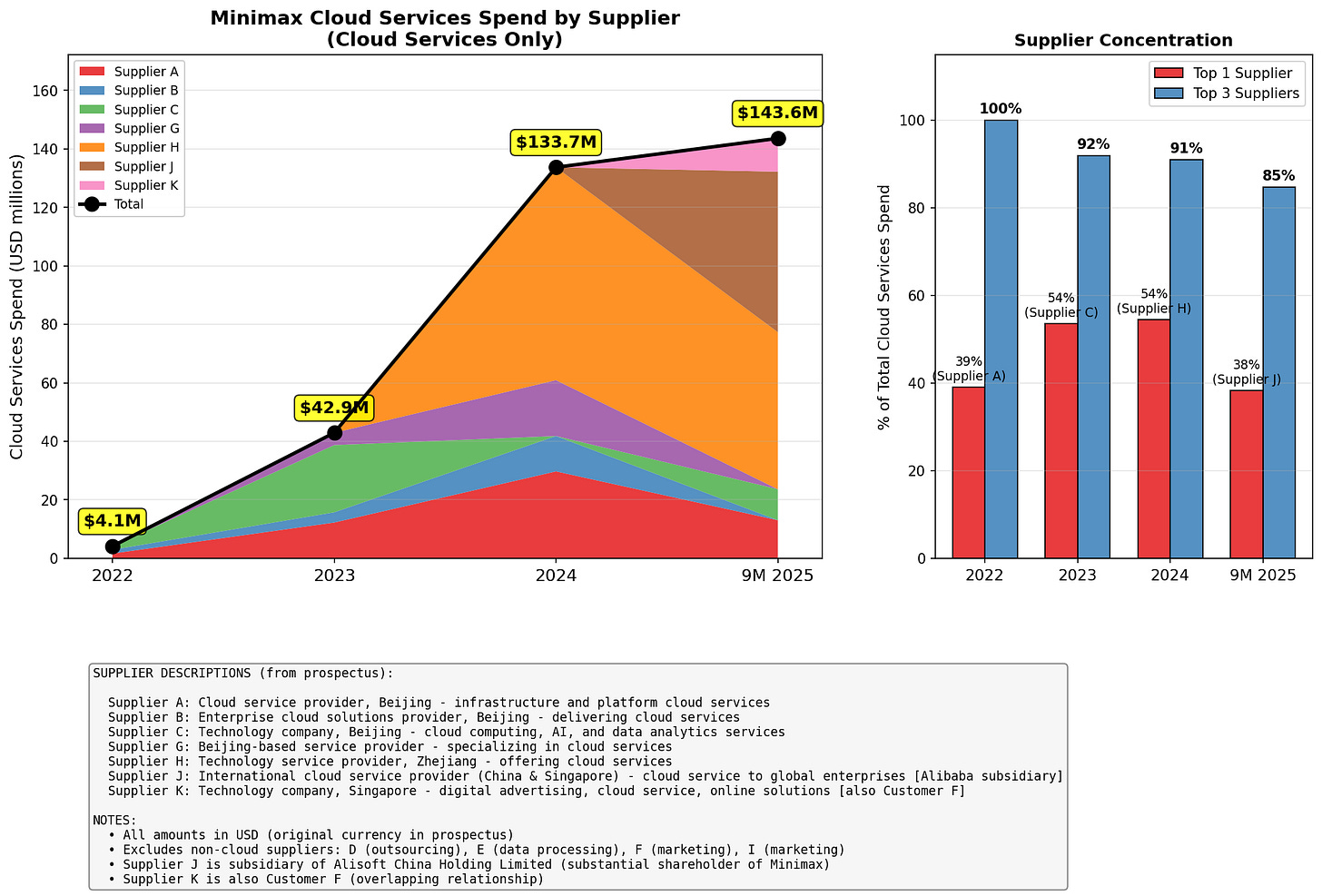

Over the course of its existence, MiniMax has used a diverse range of cloud computing suppliers as its compute demand skyrocketed. Suppliers A, B, C, G, and H are Chinese firms, I and K are based in Singapore, and J is incorporated in both. (Letters used to anonymize suppliers in the chart above reflect the letters used in MiniMax’s original prospectus.)

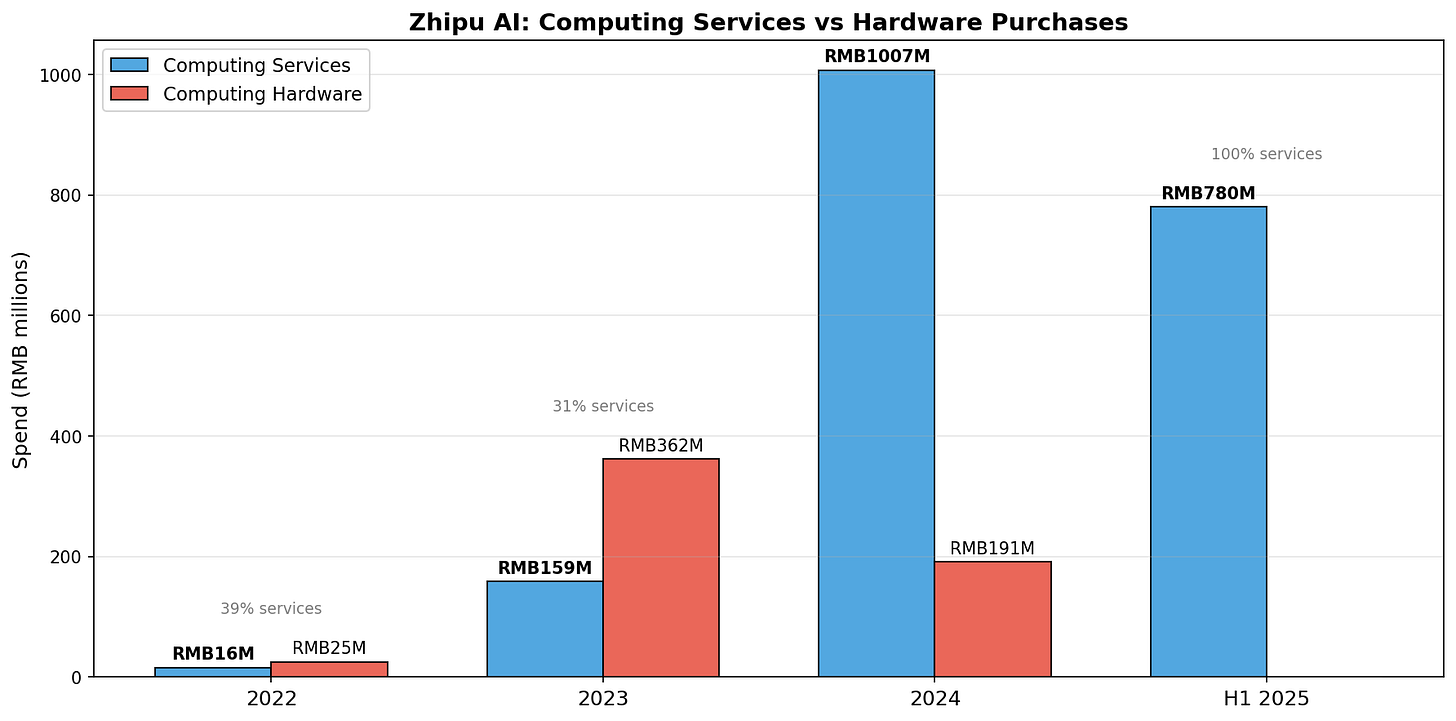

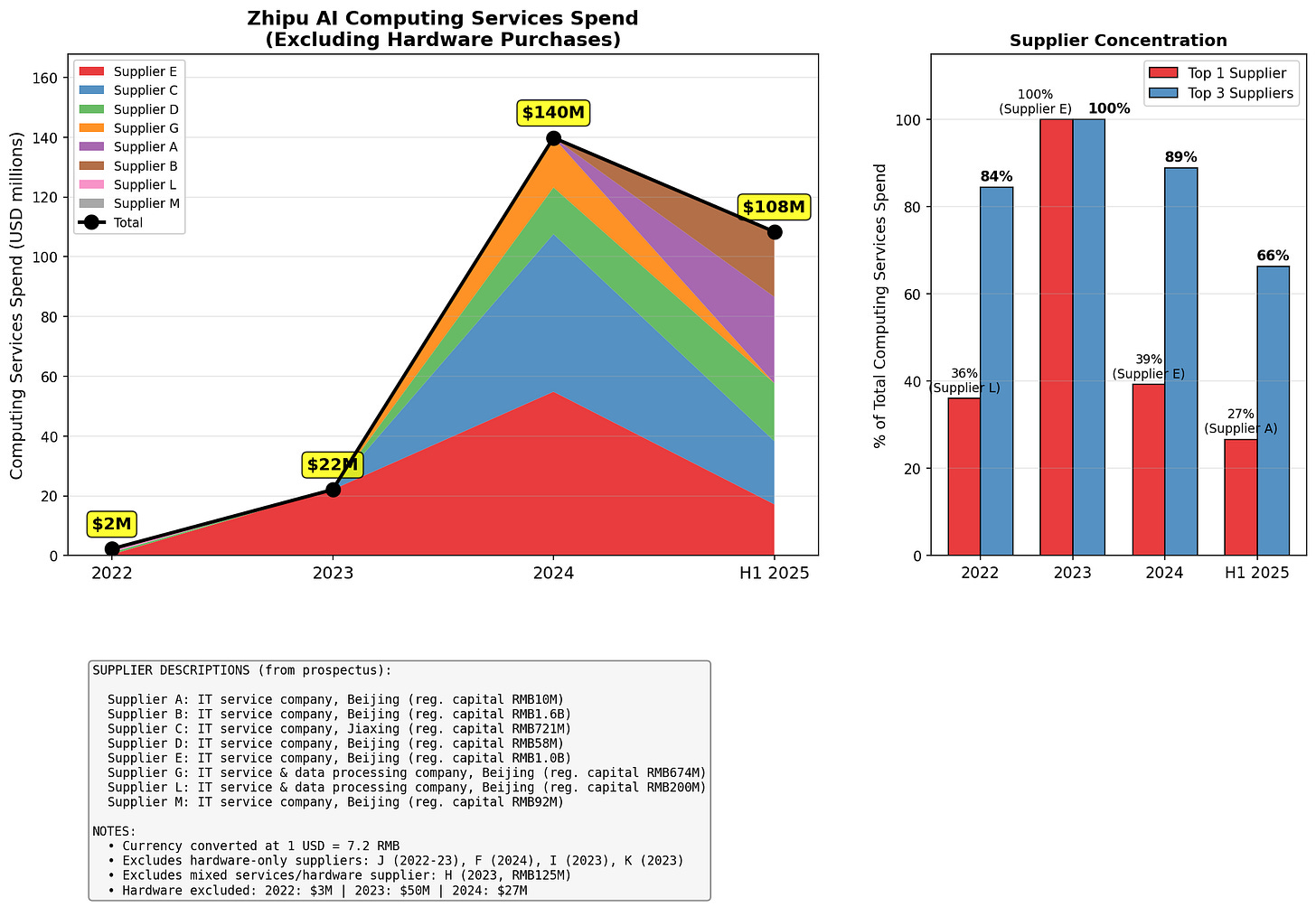

Zhipu is not quite as forthcoming, but it also frames computing resources as mostly coming from outside providers. In 2022 and 2023, some of the company’s largest purchases were sourced from suppliers of “computing hardware” rather than “computer services” (the latter, in this context, tend to mostly denote cloud computing), implying some degree of local compute.

By 2025, however, all of its top-five suppliers were cloud computing providers. Given information about its top-five suppliers each year, we can also see that it works with an ever-changing range of cloud-computing suppliers for credit terms both long and short. All of the cloud suppliers on Zhipu’s disclosed list are Chinese.

Are there circular deals in Chinese AI?

The American AI economy is a circle-dealing bonanza. China’s situation is very different: state funds are major players, most parties are far more cash-constrained, and potential policy interventions loom large over the sector. Beijing is careful not to bet too much of the country’s economic future on unpredictable developments in AI and watches out for bubble dynamics closely.

But some Chinese AI companies do want shares of each other’s pies. Zhipu’s investors include Meituan and Tencent, while two of MiniMax’s major pre-IPO investors were subsidiaries of Tencent and Alibaba. This creates an interesting dynamic where leading tech giants’ AI initiatives are competing against startup labs, but they’re also investing in startups to improve their positioning across the sector.

Another interesting MiniMax investor is game studio miHoYo, the maker of Genshin Impact (one of the highest-grossing mobile games of all time), reflecting cross-pollination between AI companions and other entertainment industries. AI companion companies have closely courted animation and video game fans from the start, and in turn, these communities have found homes on platforms like Talkie.

What about AGI?

It’s whatever you want it to be! Companies are incentivized to describe the AI future in ways that fit their current product strategy, so it’s not surprising that the two prospectuses imagine AGI in ways clearly favorable for themselves.

Zhipu’s prospectus is a surprisingly ideological document. The company thinks LLMs are the main form factor for achieving higher levels of machine intelligence. It believes there are five stages to LLMs’ development: pretraining, alignment reasoning, self-learning, self-perception, and consciousness. We haven’t gotten to self-perception and consciousness yet, and Zhipu tells investors that they cannot guarantee achieving those stages. (They also cannot guarantee that sentient machines will still be committed to maximizing shareholder value.) Its business strategy, as proposed to investors, stems from this uncompromising worldview.

MiniMax, on the other hand, describes its goal as AI that can “[perform] the full range of human intellectual tasks” — more obviously monetizable, and perhaps more modest and flexible. Because “real world human interaction is inherently multimodal,” it argues, the pursuit of higher forms of machine intelligence should focus on multimodality instead of LLMs, and it is perhaps for this reason that its audio and video generation models have seen strong growth. MiniMax’s team is very young: the average age of its R&D team is under 30. (It says in its prospectus that users of Talkie/Xingye are also young.) It emphasizes its nimble organizational structure and youthful vibrancy in its pitch to investors. Zhipu, in comparison, stresses its deep connections to academia and hard-hitting research.

The product bringing in the largest share of revenue for MiniMax remains Talkie/Xingye, its popular AI companion app. In the first nine months of 2025, there were around 5.6 million monthly active users of Hailuo AI, MiniMax’s video generator; Talkie/Xingye had 20 million in the same period. This was despite the company cutting marketing spending by 90% in that period to focus on organic growth.

MiniMax is aware of the social risks of AI companions, but its framing of these issues can be hilariously naive. A literal quote from the IPO prospectus:

As model intelligence and memory capabilities continue to advance, we foresee a future ‘Her’-style moment where everyone has an AI companion that truly knows them and proactively assists in all aspects of their lives.

The Torment Nexus is evergreen:

MiniMax thinks the future of digital companionship stretches as wide as humanity does, with a new generation of AI-native internet users “naturally inclined to interact with AI companions.” There is some acknowledgement of the legal risks companion misuse may create for shareholders, but otherwise, their lawyers have curated a sunny attitude towards a future where we’re all emotionally entangled with language models.

A grab bag of miscellaneous observations

Cultural and media industries in China are procuring a surprising amount of AI technology. One of MiniMax’s biggest customers is “[a] comprehensive cultural industry group headquartered in Shanghai, China, with digital reading as its foundation and IP cultivation and development at its core.” (It’s almost certainly Yuewen Group 阅文集团, a Tencent-backed digital reading conglomerate.) Zhipu’s top client in 2025, an unnamed IT company, primarily engaged it to work on “art-related learning services, live-streaming e-commerce, cultural tourism research and study, smart education services, and AI education.”

From Zhipu’s prospectus, we learn that the partially state-owned company iFlytek had the biggest market share for LLMs in China at 9.4% in 2024. Zhipu ranked second with 6.6%, followed by Alibaba (6.4%), SenseTime (6.1%), and lastly Baidu (4.7%). Zhipu’s analysis implies that iFlytek reached the top of the market by rolling out LLM-based services to its existing user base, which is very large. This is a reminder not to write off state-affiliated players in the Chinese AI industry, especially ones with massive access to surveillance data and public-sector partners like SenseTime and iFlytek. (MiniMax’s founder himself is a SenseTime alum.)

Zhipu made a preliminary filing for an A-shares listing back in April 2025, but ultimately decided to list in Hong Kong to attract a broader base of overseas investors.

Zhipu tries to distinguish itself as the only major Chinese AI player to care deeply about safety as it is understood internationally. It was the only Chinese company to sign the Frontier AI Safety Commitments in Seoul back in 2024.

Zhipu doesn’t think either open- or closed-source AI will “win.” As its prospectus describes, “[in] the future, open-source models will play a key role in driving technical innovation and fostering collaboration within the community, while closed-source models will take the lead in commercial applications and enterprise services.”

The biggest USD investor in MiniMax’s IPO, with $65 million, is the Abu Dhabi Investment Authority.

MiniMax has two major subsidiaries based in Singapore: Subsup, incorporated in 2022, and Nanonoble, incorporated in 2024. It begs the question: why didn’t MiniMax pursue the “Manus maneuver” and move overseas altogether? What are the best arguments against “China shedding” as an AI company?

The AI girlfriend business has razor-thin margins. The average Talkie/Xingye customer spent only US$5 in the first nine months of 2025, and the number actually went down from 2024 to 2025 as MiniMax tried to court a larger international user base that’s cost-conscious. (According to Sensor Tower, the US, the Philippines, and Mexico have the largest numbers of Talkie users.) Recurring revenue is also more complicated for this side of their business, as users can pay on-the-go for tokens rather than subscriptions.

MiniMax brings up an interesting dimension of open-source software use in the “Risks” section of their prospectus. They argue that since the terms of many open-source licenses have not been interpreted by courts, these licenses might later on be “construed in a way that could impose unanticipated conditions or restrict our ability to commercialize our products.” Will companies ever start to legally weaponize vague open-source licenses to compete with each other?

All this only scratches the surface of the information disclosed in these two documents, which give us rare insight into the AI business in China as it stands today.

Have more thoughts or observations? We’d love to hear from you!

For more analysis, check out coverage by Hello China Tech here and 36Kr here.

Great post, just a note that the market share data from Frost & Sullivan were for 2024. Almost certainly saw huge shifts last year after the DeepSeek moment - but absolutely agree not to write off the old-time players like iFlytek and SenseTime

Super interesting article. I’m genuinely surprised by Zhipu’s view on the future of AI in its IPO document. Basically, I don’t expect an AI lab to offer even a minimal critique of the consequences of AGI